Q2 2025 IoT Insights: Global Availability of Cellular IoT Technologies

July 8, 2025

Enterprises rolling out IoT need clear insight into legacy network shutdowns and upcoming connectivity options. Long device lifecycles make it essential to track coverage changes and plan migrations early to avoid costly surprises.

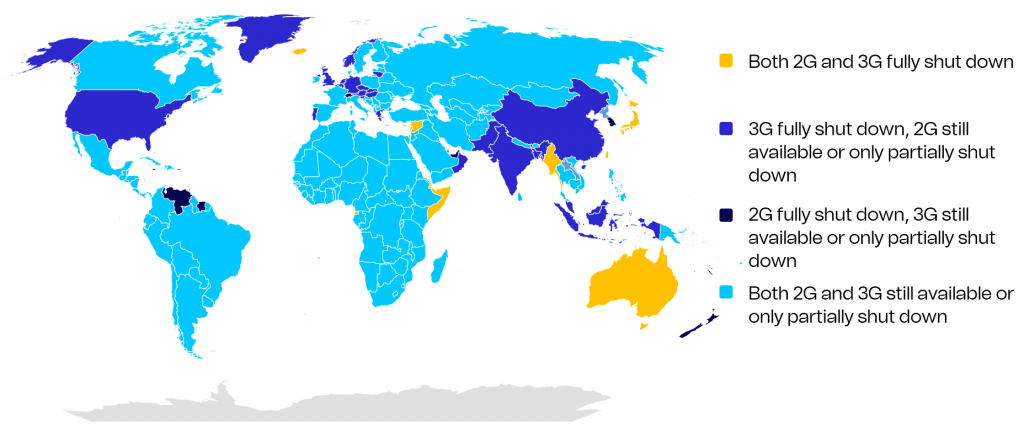

Starting with the legacy networks, 2G and 3G, the situation is somewhat complex but still fairly straightforward: operators around the world are retiring these networks to free up spectrum for 4G and 5G.

However, network shutdown schedules vary significantly across different regions:

Even within the same market, each operator follows its own schedule. For example, Vodafone Germany plans to switch off 2G by the end of 2030, Deutsche Telekom targets mid-2028, and O2 Germany has not yet set a date. Therefore, enterprises should actively monitor operator-specific shutdown timelines, rather than relying solely on regional or country-level generalisations.

The actual process of network shutdowns typically unfolds in stages over many years rather than as a single abrupt event. High-band frequencies get repurposed first, while low-band holds on longer to maintain basic coverage. Even though modern multi-mode modules can fall back automatically to a different network layer when the primary option is shut down (for example, from 2G to 4G), real-world experience shows that firmware limitations or weak signals could cause issues, and may require manual or remote device resets to re-establish a stable connection on alternative networks.

For more context, see our overview of the 2G/3G sunset.

While tracking shutdowns is crucial, so is recognizing which IoT technologies are here to stay.

Worth mentioning is the dominance and longevity of 4G.

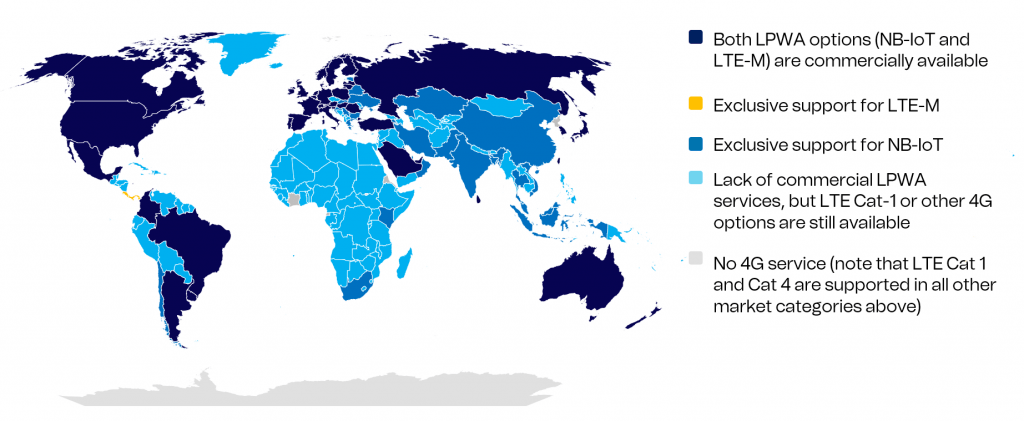

Since their 2017 launch, 3GPP-standardised LPWA technologies — NB-IoT and LTE-M — have grown steadily but with uneven global adoption. China leads in NB-IoT, Europe and North America support both, while some markets offer only LTE-M. Roaming gaps and operator withdrawals (e.g., AT&T, NTT DoCoMo) mean neither provides true global coverage. Enterprises deploying global IoT solutions with LPWA must manage dual modems, SIM profiles, and roaming complexities.

In contrast, LTE Cat-1 has emerged as the universal choice for low-bandwidth IoT. It offers sufficient throughput, acceptable latency, voice support, and seamless 4G roaming. With no special network setup required, Cat-1 devices work in nearly any 4G market and are easy to integrate into global fleets. As adoption grows and the ecosystem matures, LTE Cat-1 offers a strong cost/performance balance — ideal for replacing 2G/3G devices while minimizing integration effort and maximizing coverage.

A full 4G shutdown by 2035 seems unlikely in most markets. While mid- and high-band spectrum may be repurposed for 5G and future 6G, low-band (e.g., 900MHz) will likely remain to support wide-area and deep-indoor 4G coverage, including for Cat-1 devices. The gradual retirement of 2G — spanning years beyond initial shutdowns — offers a clear precedent. 4G is expected to follow a similar path, gradually scaling down but continuing to support most enterprise IoT applications well into the mid-2030s.

To learn more about the full spectrum of global cellular IoT technologies and their current state and outlook we advise you to read our latest IoT Technology white paper. Here you also find the sources for the above numbers and calculation, based on insights from Telenor IoT and Analysis Mason.