January 23, 2023

APAC will soon accelerate IoT deployment, pushing the adoption of the Internet of Things into unprecedented growth. No other region has the same capacity for growth.

The IoT can help solve some of the most important challenges and opportunities that come with rapid urbanisation, digitalisation, and ageing populations.

In Telenor IoT´s Asian IoT Megatrends report, we explore the drivers and differentiating factors of IoT deployment in APAC, as well as examples of customer success stories from key verticals.

APAC’s megacities demand smart solutions

APAC is home to some of the world’s fastest growing cities. If these sprawling megacities are to become places where you can breathe the air and move around smoothly in a secure way, they need to beat the negative effects of mass urbanisation e.g. traffic congestion, pollution, ineffective waste management, and so on. Smart solutions, and importantly IoT offer the answer.

Similarly, aging populations are accelerating the need for digital health solutions and even the digitalisation of the entire health industry while low-cost sensors, lower costs of data and 5G technologies are fuelling the growth of IoT.

To take advantage of these technology trends the public and private sectors would need to work together to create the necessary infrastructure. This creates an urgent opportunity and means digital transformation cannot remain in the great factory of proof-of-concept. The time is now.

The Asia-Pacific region to experience IoT scale like never before

Following the pandemic-driven changes, enterprises are now opting for IoT-led, digital approaches as part of their go-to strategies for technology. Remote/hybrid operations have become common, requiring fast and stable network coverage. Countries such as China, Singapore, South Korea, and Japan had kickstarted their digital journey long before the global pandemic, but with rapid acceleration in adoption and cross-country collaborations, countries such as Thailand, Malaysia, and Indonesia are now picking up the pace.

APAC has always been an innovator in new technology concepts, such as smart cities, metaverse, and digital twins*, as well as the increasing rollout of 5G connectivity and use cases – for example, Seoul deploying sensor-enabled smart poles and buildings, as well as drones to monitor fine dust emissions as part of smart city initiatives.

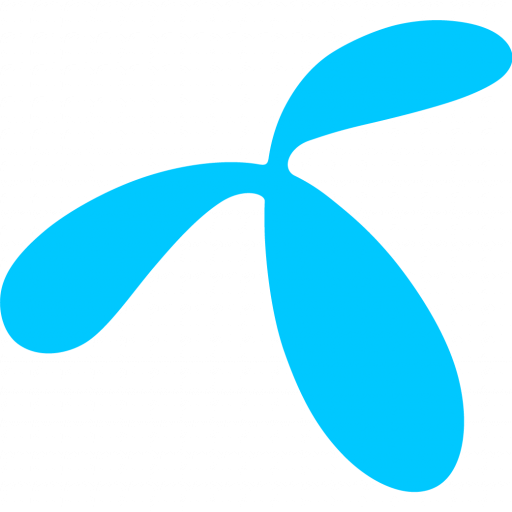

Figure 1. APAC versus the Rest of the World on IoT

Source: Omdia

*Smart cities: Technologically integrated urban areas to modernize services (e.g.traffic control, lighting, carbon emission).

Metaverse: Immersive virtual experience/environment enabled by technology such as augmented/ virtual reality.

Digital twins: Virtual representation of physical environment where processes such simulation, testing, and integration can be performed with real-world data.

However, as Asia-Pacific moves out of the pandemic, the coming 12 months will see a huge and rapid transition as IoT deployments move from theory to practice on a scale not yet seen.

Whilst APAC may have been behind the curve on IoT deployment to date (see figure above), huge deployment at scale is poised to take place in the coming years – not least as enterprises can take advantage of the learnings and best practice of the Rest of the World’s IoT activity to date.

According to Omdia’s IoT Enterprise Survey Regional Report – Asia and Oceania 2022, 88% of industry respondents said that IoT was either core to their digital transformation process or is being deployed across multiple areas in their organizations.

The survey also shows a gradual increase in enterprises’ confidence in deploying IoT solutions within APAC, where 55% have deployed more than one IoT project, and 29% are deploying more than five projects.

The direction is clear – IoT growth in the Asia-Pacific region is on the edge of explosive and transformational growth.

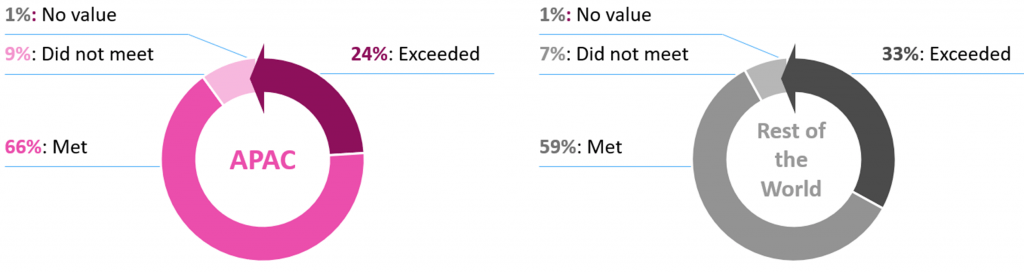

Figure 2. IoT Project Value – APAC versus Rest of the World

“Which best characterises the value your IoT projects (fully deployed or POC) have delivered to your organisation?” (Answers ‘versus expectations’)

Source: Omdia IoT Enterprise Survey Report –2022

In proving a Return on Investment (ROI), 90%+ projects pass the grade – but are less likely to exceed expectations in APAC (24%) than in the Rest of the World (33%). Many APAC projects driven by small/medium businesses, the price sensitivity and need for quick ROI is strong – especially as earlier, more foundational technology is established – meaning these owners can be harder to impress at first.

With 93% of respondents saying they expect to see an ROI within the first 24 months, the pressure is on for both enterprises and their partners to deliver.

Ask an IoT expert

The IoT sustainability charge

Accountability around environmental, social, and governance (ESG) issues is also growing within APAC, especially with developing/revamping of many government policies and regulations forcing the issue, including:

- The Singapore Green Plan 2030 focuses on five pillars: nature, energy reset, sustainable living, green economy, and resilient future. Key targets include quadrupling solar energy by 2025, 20% of carbon neutral schools by 2030, and reducing 30% of waste sent to landfill by 2030.

- The South Korea 2050 carbon neutrality roadmap ranges from restricting LNG and coal consumptions for power generation, to replacing internal combustion engine vehicles with battery-based and hydrogen-powered electric vehicles.

- Part of China’s 14th Five-Year-Plan (2021 – 2025) focuses on energy and climate, with targets including 18% reduction of CO2 emissions per unit of GDP, and 13.5% reduction of energy consumption per unit of GDP).

This renewed focus increasingly means sustainability is a goal from the outset of projects. Omdia’s survey showed 24% of APAC enterprises saw/expect to see improved energy efficiency through IoT projects, and 19% expect energy and waste reductions – figures marginally ahead of the global curve – but based largely around projects already into deployment.

In considering their future IoT strategies, a much higher 44% of enterprises say their IoT deployments are being targeted at certain aspects of their sustainability goals, and 40% say IoT is crucial for their larger sustainability goals.

Today’s strategy is driving tomorrow’s IoT deployment – and the growing focus on sustainability is only set to increase for both public and private buy-in for future projects.